Let’s say your company’s average AP balance stays right around $15,000, and you pay about $30,000 in bills each month. Over the course of 3 months, you’d still have an average balance of $15,000, but you would pay $90,000 in bills. Very few real-world companies will have such a high AP turnover ratio over that time frame because very few companies pay every bill the day after it comes in the door. The important thing is to make sure the time period you choose is as “typical” for your company as possible. If your AP balance changes a lot between the beginning and end of the month, don’t just look at the first 5 days or the last 5 days.

Accounts Payable Turnover Ratio: What It Is, How To Calculate and Improve It

Your company’s accounts payable software can automatically generate reports with total credit purchases for all suppliers during your selected period of time. If it’s not automated, you can create either standard or custom reports on demand. The Accounts Payable Turnover Ratio is a crucial financial metric that measures the efficiency with which a company is managing its accounts payable.

- Accounts payable turnover is a ratio that measures the speed with which a company pays its suppliers.

- Lower accounts payable turnover ratios could signal to investors and creditors that the business may not have performed as well during a given timeframe, based on comparable periods.

- Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

- Measured over time, a decreasing figure for the AP turnover ratio indicates that a company is taking longer to pay off its suppliers than in previous periods.

- To balance cash inflows and outflows, compare your accounts payable turnover ratio with your accounts receivable turnover ratio.

accounts payable reports to track performance

In other words, your business pays its accounts payable at a rate of 1.46 times per year. In general, you want a high A/P turnover because that indicates that you pay suppliers quickly. However, you should always find out why your A/P turnover ratio is trending xerocon san diego 2019 high or low. While a high A/P turnover can be positive, it could also mean that you pay bills too quickly, which could leave you without cash in an emergency. When getting the beginning and ending balances, set first the desired accounting period for analysis.

History of payments report

Whether you run a balance sheet for the entire year or just December 31, your AP balance between the two reports will be exactly the same. It’s the balance on the last day of that time period that’s actually being reported. Nimble, high-growth companies rarely wait until the end of the year to conduct financial analyses. Instead, they make it a habit to track key metrics like cost of goods sold (COGS), liquidity ratios, high account balances, and more on a regular basis. On the other hand, maybe it’s already quite high, and a lower ratio could help you increase your cash reserves. Consider the factors of your specific industry and your current financial position to set the right strategic target for your own business.

Beginning and ending accounts payable

A formal audit will ensure that your financial statements are prepared in accordance with generally accepted accounting principles, or GAAP. You can generate a recurring invoice report manually, but many business owners use accounts payable automation solutions to build theirs. This report shows which invoices recur from month to month, quarter to quarter, or over some other period.

So, while the accounts receivable turnover ratio shows how quickly a company gets paid by its customers, the accounts payable turnover ratio shows how quickly the company pays its suppliers. The accounts payable turnover ratio shows investors how many times per period a company pays its accounts payable. In other words, the ratio measures the speed at which a company pays its suppliers. While businesses may have strategic reasons for maintaining lower accounts payables turnover ratios than cash on hand would show is necessary, there are other variables. Similarly, they might have higher ratios because suppliers demanded payment upon delivery of goods or services. Some companies may spend more during peak seasons, and likewise may have higher influxes of cash at certain times of the year.

Because the turnover of payables is unique to each business type, you’ll gain the most valuable information for your investment analysis by comparing companies within the same industry. This gives you a constant picture of your company’s financial health, helping you manage your finances in a proactive way. Your AP turnover ratio is generally more important than DPO in making business decisions, but DPO provides additional information to paint a more complete picture of your accounts payable.

With this data at your fingertips, cross-departmental collaboration becomes more productive, allowing you to identify opportunities to improve efficiency and AP turnover to help the business grow. Another industry that can benefit from a high Accounts Payable Turnover Ratio is the healthcare industry. Healthcare providers need to purchase a large volume of medical supplies and equipment, and they need to pay their suppliers on time to ensure a steady supply of essential items. A high Accounts Payable Turnover Ratio can help healthcare providers negotiate better prices and payment terms with their suppliers, which can ultimately lead to cost savings for patients. When you purchase something from a vendor with the agreement to pay for the purchase later, you make an entry into your accounting system debiting an expense and crediting accounts payable. Now that you know how to calculate your A/P turnover ratio, you can try to improve it by following our tips below.

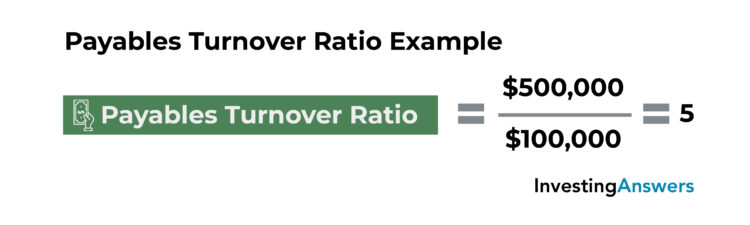

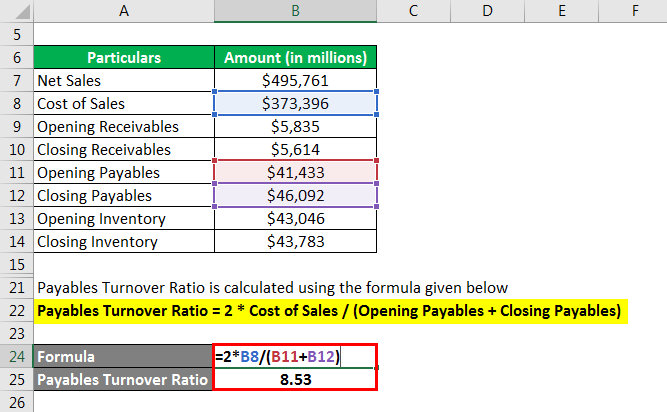

Unlike many other accounting ratios, there are several steps involved in calculating your accounts payable turnover ratio. Businesses with a higher ratio for AP turnover have sufficient cash flow and working capital liquidity to pay their suppliers reasonably on time. They can take advantage of early payment discounts offered by their vendors when there’s a cost-benefit. Possibly they can negotiate even more types of discounts from happy suppliers. That means the company has paid its average AP balance 2.29 times during the period of time measured. That all depends on the amount of time measured, along with current AP turnover ratio benchmarks and trends over time in the SaaS industry.

While that might please those stakeholders, there is a counterargument that some businesses may be better off deploying that cash elsewhere, with an eye toward growth. Add the beginning and ending balance of A/P then divide it by 2 to get the average. You may check out our A/P best practices article to learn how you can efficiently manage payables and stay fairly liquid. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. If we divide the number of days in a year by the number of turns (4.0x), we arrive at ~91 days.