Posts

To incorporate an identical cards otherwise notes for the Fruit Watch, utilize the Watch application. Go to the My personal Watch tab and you can faucet on the Handbag & Apple Pay alternative. This will give your wearable a comparable electricity since your genuine cards, you’ll manage to pay with your smartwatch even when the iphone 3gs isn’t nearby. Which have one to shorter thing to take as much as seems high, however some somebody require sticking with a ol’ money because of security inquiries. Due to this it’s vital that you recognize how software-based payment programs work and how they can in fact protect the money better yet than just a credit.

Each one of these also provides benefits to your cellular telephone payments, in addition to some other significant professionals. If or not you employ they to manage your money, publish currency so you can family or just read the current cat memes, your own cell phone is probably a big part in your life. Bank card repayments be a little more secure since the no-one can intercept the brand new commission. The bucks goes from their fee processor in the supplier savings account. Delivering percentage out of your mobile phone increases the newest checkout procedure since you wear’t need follow a single POS dining table.

Once again, identical to Apple Pay, the system will be sending a third party token as opposed to your real cards facts. Technology about app-based payment networks is called Close Career Correspondence. It is market fundamental and you can each other Google and you will Apple have fun with it for their very own features. It indicates the mobile phone usually properly shop your cards information and you can it acquired’t show them with one third parties. If you would like purchase when you take a trip otherwise shop around the world online, you could be best off with a wise account and you can card.

Merely touching the fresh cards you want to play with immediately after twice-clicking – you will find them all bunched upwards towards the bottom of your own display. Google Shell out is extremely comparable but is made from the Bing and you can allows users from both Android os otherwise apple’s ios devices, tablets otherwise observe to make contactless purchases. Similarly to Fruit Shell out, contain more to this wallet than just borrowing from the bank otherwise debit cards. Fruit Shell out is actually a contactless way for ios users and then make payments. They spends biometric screening tech called Face ID otherwise Touch ID, or you can explore a great passcode to gain access to the new wallet.

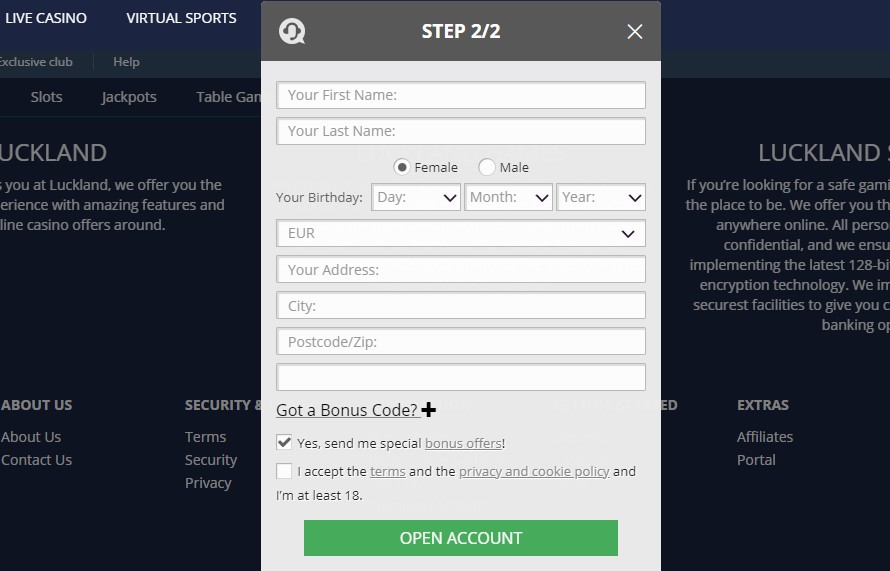

When you get indeed there, merely sign in a free account from the filling the required advice. To the Q88Bets Gambling enterprise, you’re able to gamble highest-top quality game to your ProgressPlay’s expert program. You’ll find around step one,400 online game in the list, in addition to alive online game away from Progression.

Develop a business.

Inspite of the identity, Samsung Spend deals with one modern Android os cellular phone, but which availability doesn’t change in order to smartwatches, because the program just works on the brand’s very own Galaxy range. Setting it up, download the new Samsung Pay app and you can include the notes. If this’s time for you spend, only open their cellular phone using your type choices (fingerprint, face, otherwise PIN), then hold the unit against the critical to utilize your cards.

The new Fruit Card is a wonderful credit option for mrbetlogin.com Read Full Report individuals who is keen on Apple products and Apple Pay. The average deposit restrictions to own mobile asking is actually £10-£40 for every put, that have a total of £240 a day. Each of our recommendations provides a huge environmentally friendly ‘Play HERE’ switch that takes you right to the newest local casino.

Once you like to use (and they are approved) to possess a different charge card as a result of our website, we would discovered compensation from our lovers, and therefore get impression exactly how or where these products are available. Please consider the adverts plan and you may unit opinion methodology for more information. Finding the right cards for this reason actually a simple task while the few private handmade cards provide a specific perks category, along with mobile phone bills. Surprisingly, organization handmade cards usually give you the better advantages for spending come across monthly payments for example mobile phone provider.

Speak to your local transportation company understand if this now offers an application using NFC tech to collect ride prices and you will consider seats. The particular means this technology try contained in public transit have a tendency to are very different because of the area. After you install a mobile wallet (or the her or him) on your device, you’re prepared to make costs. The newest cards along with pays step three% cash return to your sounding your decision, in addition to plane tickets, lodging, auto leases, gas, and you may dinner. That it cards and provides dos% money back on the food or gasoline, and step one% money back every where otherwise. That makes it a solid come across to have using the cellular telephone costs and you will generating benefits to the relaxed investing.

- And if your take a trip or store on line which have around the world retailers, make use of card in the two hundred places to invest such a neighborhood and you may withdraw at any place.

- We try to offer factual statements about services you might find interesting and useful.

- When paired with almost every other Chase cards regarding the Greatest Benefits loved ones, you could transfer those funds back to issues if you wish – so it’s one of the most worthwhile notes on the wallet.

- Some mobile gambling establishment extra offers try solely intended for profiles out of the newest mobile variation, even though really will likely be reached by the people.

How to Tap-to-Spend using my Device?

If you want to score an update out of dated bucks and you can cards but you’re unfamiliar with software-based payments, remember that they’s as well as more straightforward to rating establish than you may imagine. Actually, you really features the majority of everything you’ll you need currently mounted on your own cellular phone. Your card information aren’t stored on the mobile phone otherwise check out and you will remove the debit otherwise credit card information of your own device, even though you eliminate it. You’ve most likely viewed an electronic digital Purse in action, or have the application on your cell phone, but do you know how to use it? Electronic Purses offer comfort by permitting one to use your cellular phone or other electronic gadgets to cover anything as opposed to bucks or the plastic material credit card. From there, you’ll need to realize any authentication prompts you’re able to ensure the identity.

To have Investment You to definitely items listed on this site, a number of the advantages may be provided with Visa otherwise Credit card and may will vary by product. Understand the particular Guide to Benefits to own info, because the conditions and you can exceptions implement. Exactly why are it credit special, specifically, ‘s the power to move your step one.5% cash-back to step one.5x Biggest Benefits items, as long as you have the correct credit card pairing.

You can one debit otherwise charge card and Fruit Cash, boarding tickets, knowledge entry, present cards and much more to your handbag. Fruit Pay try widely acknowledged in the stores and dining inside the community. Cellular costs features numerous levels from vibrant security, causing them to an extremely safe treatment for spend. They’re also far more safe than magstripe costs and only while the safer since the EMV processor cards repayments. In reality, if you’lso are having fun with a cellular payments application with Deal with ID, such as Apple Pay, it’s probably safer than simply an enthusiastic EMV processor chip card fee.

Must i fool around with a mobile wallet during the an automatic teller machine?

Anything you create is actually ring-up a purchase, discover the brand new green white to look on the Rectangular Reader, and also have the consumer contain the cellular phone across the device so you can pay. The technology you to definitely underpins mobile wallet repayments is actually near occupation communications (NFC). Here is what enables a couple gizmos, such since your cell phone and you may a costs reader to speak without any cables after they’re also romantic with her. Typically, a mobile device needs to be in this a few in out of your readers to help you procedure the brand new commission. NFC try a great subset away from radio-volume personality (RFID), a phenomenon enabling us to pick something because of broadcast surf. RFID has been utilized for many years to check contents of supermarkets and you will luggage on the baggage says.

Although not, the credit card advice we publish could have been authored and you can examined because of the experts who learn these products inside-out. I merely recommend items i possibly fool around with our selves otherwise promote. Your website doesn’t come with all the credit card companies or all readily available charge card now offers that are in the market. See our adverts coverage here in which i listing business owners that individuals work on, and how we profit.