At the time you closed the books, when something wasn’t paid, it may be paid now. You’re trying to juxtapose all the three things and that’s next to impossible. Our finance data platform has made it easy to offset reversals without having to pull data from disparate data sources. And you can see all of the onsets and offsets of a single customer or a single record all in one place, which is not the case for most companies. Expert advice and resources for today’s accounting professionals.

Gross Margin Calculation

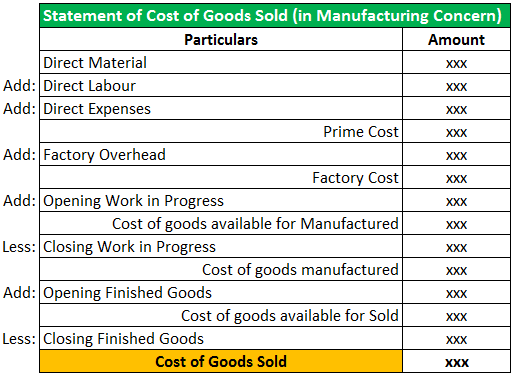

Cost of goods is the cost of any items bought or made over the course of the year. Ending inventory is the value of inventory at the end of the year. So the cost of goods sold is an expense charged against Sales to work out Gross profit. These pens are now known as inventory because they are purchased with the intention of resale. You need a good labor tracking system to keep an eye on labor productivity and allocation. With this, you can ensure all employee wages tied to making goods get included in COGS properly.

Accounting for COGS (Cost of Goods Sold) Examples

- This example illustrates how COGS is determined and the importance of accurate inventory tracking for retail businesses in assessing their cost of sales.

- Thus, the business’s cost of goods sold will be higher because the products cost more to make.

- Accuracy in each costs of good sold journal entry depending on your specific situation in crucial.

- Some service companies may record the cost of goods sold as related to their services.

- However, the ending inventory is determined to be $65,000 instead.

It includes the cost of all the materials, labor, and overhead expenses that are directly related to the creation of these products. Additionally, optimizing the supply chain can help reduce the costs of moving materials and finished products. Consolidating shipments, opting for local suppliers, and using just-in-time inventory management systems can help streamline the process. The journal entry for COGS is important because it is used to calculate the net income of a business. The way in which businesses calculate and report their costs varies depending on the type of business.

Exercises to Build Confidence in COGS Entries

Weighted Average provides a smoother COGS calculation since it averages the cost of all units purchased. Let’s say the business purchases $5,000 worth of products on credit. That means a debit to Inventory and a credit to Accounts Payable in the amount of $5,000.

Next up are examples of how different costs show up in COGS journal entries. In other words, divide the total cost of goods purchased in a year by the total number of items purchased in the same year. Its primary service doesn’t require how to record cost of goods sold journal entry the sale of goods, but the business might still sell merchandise, such as snacks, toiletries, or souvenirs. Let’s say a further direct cost of $200 is incurred on labor, and this gives us a total cost of goods sold of $600 ($200+$400).

The Importance of Recording COGS Accurately

The inventory account is of a debit nature, and crediting it will decrease the value of closing inventory. The cost of goods sold is also increased by incurring costs on direct labor. In this journal entry, the cost of goods sold increases by $1,000 while the inventory balance is reduced by $1,000. There are several reasons why it is essential to derive a correct cost of goods sold figure. First, this may be the largest expense reported by a business, so it has the greatest impact on whether you can report a profit. Second, it is used to derive the gross profit percentage (which is net sales – cost of goods sold, divided by net sales).

This calls for another journal entry to officially shift the goods into the work-in-process account, which is shown below. If the production process is short, it may be easier to shift the cost of raw materials straight into the finished goods account, rather than the work-in-process account. The calculation also assumes that both ordering and holding costs remain constant. When inventory falls to a certain level, the EOQ formula, if applied to business processes, triggers the need to place an order for more units. When recording the expense of merchandise purchased by a business, a journal entry is made to debit the cost of goods and credit the inventory account. That may include the cost of raw materials, the cost of time and labour, and the cost of running equipment.

And this is usually done in order to close the company’s accounts at the end of the period after taking the physical count of the ending inventory. The balance in inventory account at the end of an accounting period shows the cost of inventory in hand. The accuracy of this balance is periodically assured by a physical count – usually once a year.

The march towards greater precision in COGS can be significantly bolstered by implementing Inventory Management Tools (IMS). Such systems make tracking COGS a more accurate and less cumbersome process. Each inventory item is uniquely identified—often with barcodes or QR codes—allowing for pinpoint tracking throughout the inventory cycle. With A2X, for instance, syncing your ecommerce channels is a snap, providing real-time insight into SKUs and inventory levels.