Knowing the difference between temporary and permanent accounts helps in understanding their roles in accounting. Temporary accounts record revenues and expenses, resetting yearly. Permanent accounts carry forward their balances, crucial for financial analysis and assessing a company’s worth. A pre-closing trial balance shows all current account balances.

Post-closing Trial BalanceDefined with Examples & Samples

- This report provides a snapshot of the company’s financial position after the closing entries.

- The post closing trial balance lists all remaining accounts with balances after the closing entries have been posted to ensure that no temporary accounts still exist.

- A pre-closing trial balance shows all current account balances.

It also boosts a company’s reputation for being financially transparent. In the end, a company’s effort to accurately report earnings and dividends shows it’s committed to a strong financial foundation and respecting its dividend promises. After posting the above entries, all the nominal accounts would zero-out, hence the term “closing entries”. You can use the report to print account balancesand activity by legal entity. The report enables you to print reportingand accounting sequences.

Why is it important to prepare a post-closing trial balance?

The Income Summary account is where these entries are summarized, reflecting a business’s profit. When a fiscal year ends, net income goes to retained earnings. This shows how a company plans to distribute profit in the future. The post-closing trial balance highlights only these permanent accounts, which are crucial for understanding a company’s equity. It’s crucial to know all balance sheet accounts with balances that aren’t zero.

Trial balance: Definition, purpose, and example

It helps with making decisions inside the company and in dealing with investors. This document meets SEC rules and is clear about a company’s financial health. Good accounting keeps a business financially solid and ready for the future. After the post closing trial balance is finished and checked for any mistakes, any reversing entries that are needed can be made before the next accounting period begins.

Related AccountingTools Courses

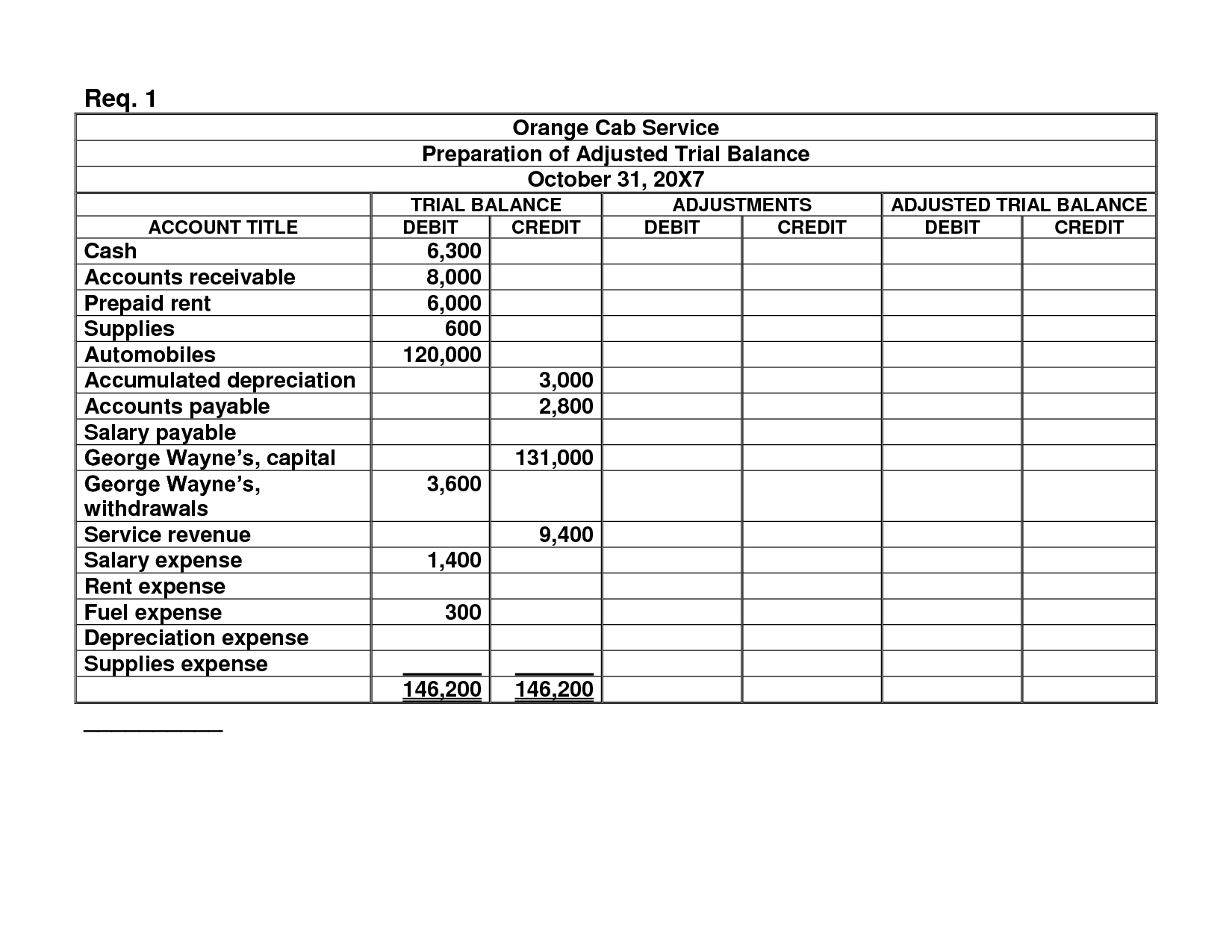

Compiling a post closing trial balance is essentially the same as for unadjusted and adjusted trial balances. The main purpose of PCTB, as you know, is to make sure the credits and debits are balanced, and it’s the last effort before closing the reported period for good. Unlike the usual Trial balance, there are no unadjusted or adjusted variations, it’s all done in one go. At the end of the day, they all serve one purpose – to ensure everything in the ledger is accounted for properly. While a post-closing trial balance and an adjusted trial balance both serve as important financial reports for a company, their purpose and content differ. Finally, the accountant prepares the post-closing trial balance by listing all accounts with their updated balances after the closing entries have been made.

What are the key differences between pre-closing and post-closing trial balances?

Before that, it had a credit balance of 9,850 as seen in the adjusted trial balance above. You probably noticed that a post closing trial balance looks a lot like a balance sheet in the format of a trial balance. In the middle column, you will place debit balances for every account, and in the rightmost column, you will place all credit account balances. Its key aspect is that it’s done after the period is closed, hence the name. Notice the middle column lists the balance of the accounts with a debit balance, while the right column has balances for credits.

Adjusted trial balance is key for an exact post-closing trial balance. This step in the accounting cycle needs detailed use of accrual accounting rules to show real financial status. Accruals, showing earned revenues or incurred expenses, are noted even without cash transactions. Adjustments ensure prepaid expenses are spread out as needed, and depreciation on assets is rightly expensed. It ends the period with balanced entries, thanks to smart software.

It might miss transactions omitted entirely from the books. There’s also a chance it’ll fail to flag entries incorrectly coded to the wrong accounts, which can ultimately small business accounting bookkeeping and payroll lead to inaccurate financial statements. You record all your accounting transactions and post them to the general ledger, then assess the debit and credit totals.

Since these are determined to be temporary accounts, it contains no sales revenue entries, expense journal entries, no gain or loss entries, etc. As part of the closing process, the balances in these movements to the retained earnings account. The unadjusted trial balance is the first draft of the trial balance after the balances are posted in the ledger to prepare a financial statement. The purpose is to test the debit and credit accuracy after the recording phase. A post-closing trial balance ensures that all temporary accounts have been closed and that the company’s books are balanced.

A post-closing trial balance is important for several reasons. Firstly, it ensures that the company’s books are balanced and all temporary accounts have been closed, providing an accurate financial position. It contains columns for the account number, description, debits, and credits for any business or firm. Various accounting software makes it mandatory that all journal entries must be balanced before allowing them to be posted to the general ledger.